06 December 2011

Art for Art’s sake?

Buy an auction house not a painting.

By Frank O’Nomics

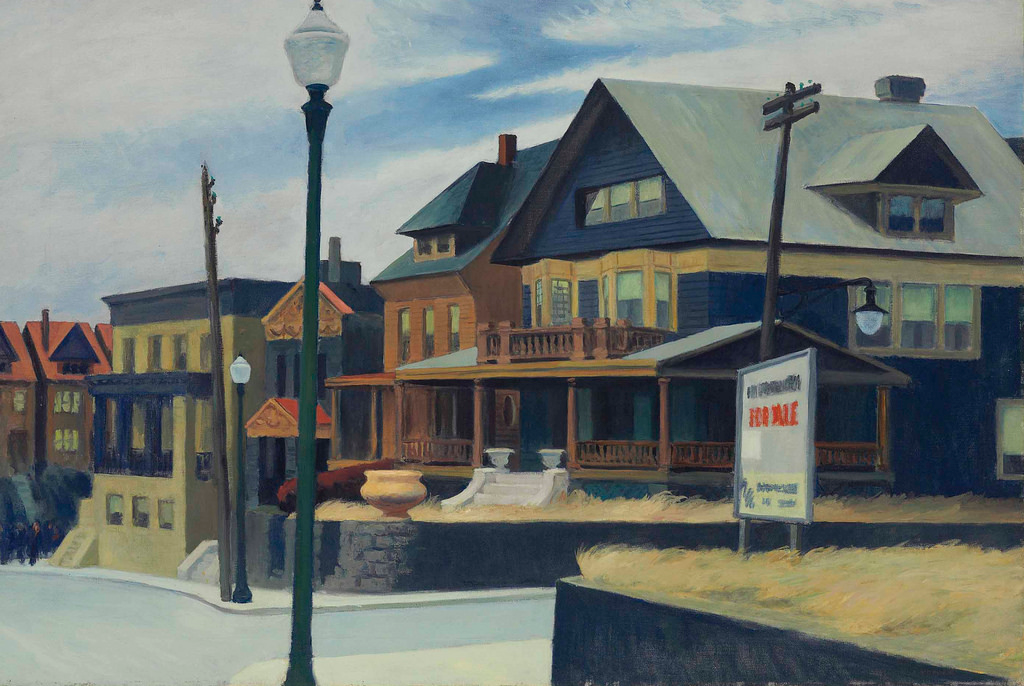

The recent sale of Edward Hopper’s painting, Chop Suey, for $92 million is remarkable for two reasons. The first is the obvious one that this was a new record for the artist. The second requires a little investigation, but when one notes that the record price for one of his works was $40.4 million as recently as late 2013, it is clear that investing in Hopper’s work has been exceptionally lucrative. Should we then be including art in an investment portfolio? As always the answer is – it depends. Investing in illiquid assets with high transaction costs is clearly not for everyone. Those costs are more likely to make art dealers, rather than art investors, wealthy.

The recent sale of Edward Hopper’s painting, Chop Suey, for $92 million is remarkable for two reasons. The first is the obvious one that this was a new record for the artist. The second requires a little investigation, but when one notes that the record price for one of his works was $40.4 million as recently as late 2013, it is clear that investing in Hopper’s work has been exceptionally lucrative. Should we then be including art in an investment portfolio? As always the answer is – it depends. Investing in illiquid assets with high transaction costs is clearly not for everyone. Those costs are more likely to make art dealers, rather than art investors, wealthy.

The beauty of art as an investment, it is argued, is that it is largely uncorrelated with other assets. Currently it appears to be moving in the opposite direction to the London property and global equity markets. Further, it can be regarded as a store of value, a role for which gold was long sought after, although gold has now lost its lustre.

If Hopper’s work represented art in general we would be hard pressed to beat it as an investment. Returning 127% over less than 5 years is impressive, particularly when compared to a 26% total return on the FTSE 100, for example. The previous highest price was for a different painting (East Wind Over Weehawken), which some may view as inferior, but given that Chop Suey is only 71% of the size of East Wind you could also argue that the returns per square cm are actually much higher.

You do, however, have to factor in some significant cost differences between investing in art and in equities. Art bought at auction is subject to a buyer’s premium of 12-25%, with VAT added on top, and sellers also have to pay various charges to have their work listed, including listing costs, warehousing, insurance, transportation, art advisors’ fees and potentially even lawyers. There was some debate as to whether Salvator Mundi, recently sold for $450 million, was really by Leonardo Da Vinci (particularly after an extensive restoration) so an opinion can often be needed. Buying from a dealer may, or may not, make the process cheaper. Anyone watching the recent episode of The Apprentice will have been struck, as well as by the ineptitude of the contestants, by the high levels of commission that they were able to charge for selling paintings and sculptures, with the artists prepared to sacrifice anything from 35-50% of the ticket price. Nevertheless, even after factoring in the costs of sale and purchase, the owners of Hopper’s paintings are still looking at close to a 100% return and roughly 4 times that of UK equities.

There are, however, some serious obstacles to treating art as an investment. The first is the lack of data. Not only do many artists rarely trade but also, even when trades happen, only a small percentage of them are recorded. Any sale privately or through a dealer will be at a price known only by the participants to the trade. There will be some data from salerooms, but only when sales actually occur. A great many works do not sell due to unrealised reserve prices. These are withdrawn and the only thing we have to work with is the guide price, which is usually very wide. The other big concern is that the market is hugely volatile and price can depend on how the art is marketed as well as timing. It may be cynical to suggest that prices go up on geopolitical events that mean wealthy people want to put their money into portable assets, and the domicile of buyers may not support the view, but it could be argued that the high price for Salvator Mundi was achieved by putting an Old Master into a sale of contemporary work to make it stand out. Further, the stunt of shredding a $1 million Banksy was clever, but do you want to buy art as a performance? (Incidentally, there was no great risk to the vendor here given that it was a print that would not normally achieve anything close to that price). What is clear from such examples is that the art market is unregulated – it is a game without rules. In addition, owners sacrifice the income on their cash for the period of ownership and will have other costs of maintaining an asset to which it is very difficult to ascribe an intrinsic value.

Let’s suppose you are prepared to put up with these shortcomings. The next question is, can we easily get involved? The price of major works is prohibitive, but many could have bought Jenny Saville’s Propped for £4,000 in 1992 and would have been more than happy with the £9.5 million sale price last month. While high risk and volatility will discourage cautious investors, for the adventurous this signals an opportunity. There are a number of ways in which those of more modest means can get involved. Buying into an art fund is a way of spreading your risk, buying works of art collectively that you wouldn’t otherwise be able to afford. The problem here is that the fund manager will make all the decisions regarding selection and timing of sales which takes away a lot of the fun – although most of us may prefer to have an expert do this. Art loans are another possibility, with the art itself used as collateral for the loan and the interest charges then deducted from the sale price. However, risk and uncertainty will make the effective interest rate very high. The third way is to use art derivatives. Owners may wish to hedge their risk by issuing a Contract on Future Sale before they sell, which investors wanting to take a positive position on the art market will be keen to buy. The attractive element here is that CFS are a product of a company (Pi-eX Ltd) that is FCA regulated. The problem is that, beyond those wanting to hedge a potential physical purchase, the main buyers will be institutions.

There is of course a final view on buying art. If we buy the art that we like and are prepared to own for an indefinite period we can regard any financial return as an unexpected bonus that we may or may not decide to crystallise.

For a much better way of making a liquid investment, why not consider buying shares in an auction house? Remember that buyer’s premium? If you think that art is going to be a good investment then 12.5% of a rising market is worth having (Christies will have made around $11 million on the sale of Chop Suey). Sotheby’s is a publically quoted entity, but their shares are down 20% this year, so the stock market does not seem to agree with art investors. Caveat emptor.